Methodology:

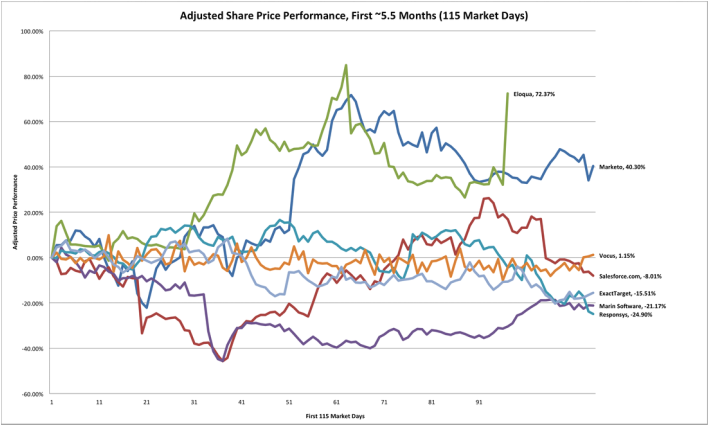

- I Compared 7 marketing companies who offer cloud based solutions: Salesforce.com, ExactTarget (later acquired by Salesforce.com), Eloqua (later acquired by Oracle), Marin Software, Vocus, Responsys and Marketo.

- For each stock, I measured price growth over the company’s first 115 market days (about 5.5 months), then divided by index growth of the S&P 500 over same period. I called this “Adjusted Price Performance”. I factored in S&P 500 data rather than straight price growth, since the IPOs of the companies I selected occurred over a 9 year period in very different market conditions.

- Here's the formula:

Results:

TakeAways:

- Marketo stacks up well - Marketo outperformed all selected companies with the exception of Eloqua. However Eloqua was acquired by Oracle on about day 97, and Oracle paid a ~30% premium over market prices. If you compare Marketo’s performance to Eloqua’s pre-acquisition price, Marketo matched or outperformed Eloqua after ~3 months in.

- Marketing Automation is HOT - It speaks to the street’s confidence in the marketing automation marketing opportunity that Eloqua and Marketo are number 1 and 2 in this comparison.

- ExactTarget + Salesforce.com = ? - If the future of Salesforce.com’s Marketing Cloud rests in the hands of ExactTarget’s leadership, it’s concerning that ExactTarget’s stock was outperformed by the S&P 500 during it’s first ~6 months as a public company. I am asked frequently by analysts about Marketo, specifically how endangered Marketo is as a result of Salesforce.com’s acquisition of ExactTarget. The best answer is that it largely depends on Salesforce.com’s ability to create synergy among a long list of acquired teams and assets. Salesforce definitely has the pieces of the puzzle: ExactTarget, Pardot, BuddyMedia, Radian6, Data.com, and BlueTail, not to mention a best in class CRM. But do they have the vision and force of will? One of the many reasons I can’t wait for Dreamforce where hopefully we will get a sneak peak.

I hope you enjoyed this exploration as much as I did!

Happy Marketing,

Chris

by Chris Russell

PS – I should probably mention that I am NOT a professional analyst (as you have probably already observed) and that I am a shareholder of both Marketo and Salesforce.com stock.

RSS Feed

RSS Feed